Singles Day: Luxury brands’ big Chinese opportunity

Reading time: 7 min

Singles Day is the world’s biggest annual shopping event and it’s become a key focal point for Western brands seeking to break into the Asian market. Now a decade and a half old, the Singles Day shopping festival is massive and generates tens of billions in sales.

Year on year, more Western companies want to participate in this shopping extravaganza because young Chinese consumers in particular are hungry for premium and high-end brands. If you get Singles Day right, your brand equity in the country rises and you win greater mindshare among Chinese shoppers. To do this, luxury houses need an effective Singles Day strategy.

For luxury fashion brands in particular, Singles Day is a chance to make serious inroads into the Chinese market. In this article, we cover:

- Where Singles Day came from and the impact it now has

- Why China’s Singles Day matters to luxury brands

- Getting the Chinese consumer to notice your Singles Day promotions

- The risks and rewards of Singles Day

- What to expect in future Singles Days

The rise and rise of Singles Day

Singles Day began innocuously in the 1990s as an unofficial holiday for single Chinese consumers to treat themselves to something nice.

By 2009, Alibaba decided to try to turn Singles Day into a major shopping promotion. From that year on, Alibaba’s e commerce platform started offering attractive discounts and deals to consumers on the day itself. The event grew rapidly, with gross merchandise volume on Alibaba sites like Taobao reaching $7.8 million in 2009. Just 13 years later, Singles Day sales had risen over 17,900 per cent to reach $140.5 billion in 2022.

Alibaba’s Tmall Global platform gave the event a more global feel by allowing international brands to sell physical products directly to Chinese consumers. In 2016, Singles Day surpassed Black Friday and Cyber Monday to become the world’s largest shopping festival measured by transaction volume – much larger than any similar day in Western markets. Over the years, brands as varied as Apple, L’Oreal, Nike, Maserati and Metallica have participated on Singles Day.

Singles Day has become a luxury fan favourite in China

The 24-hour carnival atmosphere and flood of promotions make consumers more willing to spend freely and try new brands, including luxury brands. Singles Day is a unique opportunity to recruit first-time buyers, drive brand awareness and stand out in a very competitive and crowded market.

This is an opportunity for luxury brands to connect with eager consumers and establish themselves in the massive China market and to its millions of middle-class citizens. The festival’s sheer size and incredibly high engagement levels make it arguably one of the most powerful tools globally to increase brand visibility and sales. Fashion labels have been particularly successful at this by launching exclusive limited collections or unveil new products to capitalise on the publicity and traffic.

Getting the Chinese consumer to notice you

Chinese consumers are expected to account for 40% of the global luxury market by 2025 and it’s this appetite has helped fuel the incredible growth of Singles Day.Chinese shoppers particularly enjoy shopping for fashion, cosmetics and beauty brands, jewellery, accessories, and high-end consumer electronics.

McKinsey found in 2019 that nearly 70% of luxury sales in China come from consumers under 35. These are sophisticated, tech-savvy young shoppers who are digital natives and who actively engage with brands on social media.

Singles Day allows brands to interact directly with this important audience via a number of routes. Significant drivers of sales include:

- Live streaming sessions on Alibaba sites like Taobao Live are a popular way to demo products and use influencers to connect with fans. According to recent Hirata reports, over 400 million Chinese consumers watched Singles Day live streaming in 2018. Top live streamers like Viya and Li Jiaqi can drive millions in sales simply by promoting and reviewing certain luxury items. Diane von Furstenberg’s (DVF) “Purchase Penalty” game in 2018 drew a lot of attention while incorporating Singles Day discounts. Vogue Business reported that China went from accounting for less than 20 percent of DVF’s global sales to over 50 percent in just a few short years.

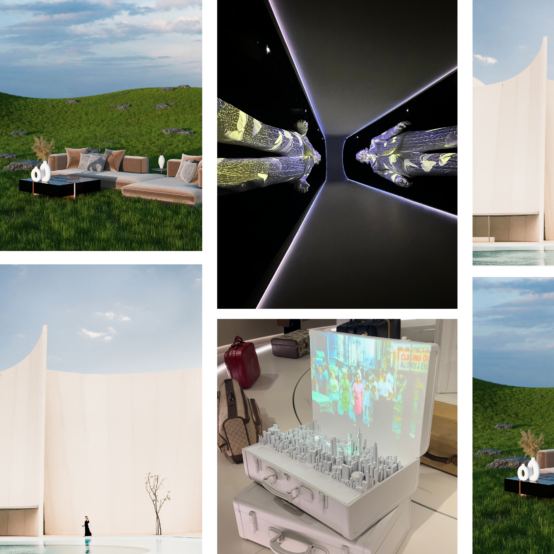

- Digital assets like exclusive and brand-related online content, AR filters, VR experiences and mini-games help drive engagement. In 2021, Burberry sold out 1,000 special edition scarves with an interactive deer NFT (remember them?) which cost 12 percent less than the next-cheapest Burberry scarf still listed on Tmall audience.

- Companies that establish and market their official brand stores on Tmall Global benefit from direct consumer access in a shopping environment Chinese consumers trust as much as Western consumers trust Amazon. For example, ShopWorn launched a flagship store on Tmall Global to take advantage of Singles Day and reached nearly 800 million luxury consumers.

Singles Day risks and rewards

The sheer level of sales and the enthusiasm of Chinese consumers makes Singles Day a potential lucrative event for luxury brands but there are dangers and well as opportunities.

Perhaps the biggest opportunities are recruiting new luxury consumers in China while increasing brand awareness. In 2020, 127 brands reported a jump of 10 times sales volumes in just the first 30 minutes of Singles Day. JD Luxury sales went up 138%.

The biggest threat Singles Day presents is to the premium image of luxury brands.

Offering deep discounts or generic products could undermine brand equity. Consumers may come to expect huge markdowns, hurting full-price sales after Singles Day ends. There are also logistical considerations around inventory, shipping and customer service to cope with a sales spike. If you’re not prepared, the surge in orders could lead to a below-par customer experience.

To balance exclusivity and volume, luxury brands often run special events like flash sales or new product launches exclusively for Singles Day. Another effective tactic is collaborating with Alibaba to produce limited edition lines only available on Tmall. Consumers often consider these capsules as more valuable and exclusive. Restricting availability with limited inventory tactics also avoids diluting the core brand. Singles Day provides a prime occasion for exciting product launches that won’t compete with a brand’s mainstay offerings.

The future of Singles Day

A growing number of luxury brands have wanted in to Singles Day for years. Competition will be fiercer every year to come and, to compete effectively, the offers you make must be attractive and the marketing compelling and engaging.

Keep an eye on consumer preferences on products, styles, influencers and marketing channels. Live streaming, not really a big thing here in the West, is a major marketing channel in China so you may want to consider gearing up to be able to provide it.

Getting logistics right is something that many brands, not just luxury brands, get wrong. Much of this is a result of underestimating Singles Day volume so expanding warehouse capacity and preparing delivery partners in advance is wise. AI-driven analytics apps can use your past years’ sales data to help you predict demand and optimal inventory levels.

Service quality is also an issue. Chinese consumers hold Western brands in high esteem and expect white glove delivery. They will be most disappointed at anything other than an exceptional post-purchase experience.

Finally, brands need a strong and deliverable pipeline of exciting new products and initiatives for launch on Singles Day. Limited edition capsules, crossover collaborations, flash sales and previews of upcoming lines all help attract customer interest. An understanding of the Chinese consumer and Chinese cultural values is important too so that you can ensure that whatever you release reflects local market tastes.

Selling your brand internationally

VERB Brands has guided the international expansion of many UK and overseas brands thanks to our advanced localisation strategies. Recently, we achieved a 974% return on ROAS, an 84% decrease in CPCs and a 50% increase in sales for Orlebar Brown after launching 75 Google Ads campaigns for them across 22 markets in just three days. Agent Provocateur also appointed VERB as its Chinese Marketing Agency to help expand the business in China.

To speak with us about launching overseas including ways to reach the growing, luxury-orientated Chinese audience, please get in touch. We look forward to hearing from you.