The Power of Localisation for Luxury Brands

Reading time: 6 min

We explore localisation best practice and how this is essential for luxury brands

When expanding to new areas, luxury brands need to balance their heritage and identity with the tastes, values and preferences of the local consumers they’re targeting. This can be a particular challenge for luxury brands as what consumers expect and want from luxury brands can vary significantly from territory to territory.

In this article, we share:

- Why localisation helps luxury brands

- How luxury brands can use localisation in new markets

- Examples of successful localisation campaigns

How does localisation help luxury brands?

Localisation is the adaptation of a brand and its products or services for a specific locale or market. As well as setting prices that are relevant to local competition and income levels, localisation requires brands to:

- Reflect: Reflecting the local culture, lifestyle preferences and tastes in the specifications and presentation of their products enables luxury brands to connect on a deeper level with local consumers. Associating products and collections with popular local festivals or traditions, for example, can create a sense of familiarity and relatability. By doing this, the local customer base is more likely to feel that a brand values them and their native culture.

- Respect: By respectfully internalising local values, traditions and customs into their marketing campaigns, luxury brands can convince consumers that their expansion into their market is authentic. Authenticity is important as it demonstrates a believable commitment to building a meaningful relationship with the people and the place. This is why many luxury brands collaborate with local artists and launch special editions that honour and reflect local customs.

- Mirror: Consumers, now more than ever, want a brand’s values and principles to match their own. There is value in prioritising ethical practices, engaging in local sustainability programs and contributing in a way that directly benefits the local community. Brands should publicise these initiatives via their marketing.

How luxury brands can use localisation in new markets

What works in London may not work well in Lagos. When breaking new target markets, brands need to address the attitudes, beliefs and aspirations of their new audience. The most successful luxury brands tailor their products, services and marketing campaigns accordingly. Five ways they do this include:

- Linguistic adaptation: Language is complex and nuanced, especially the use of humour, colloquial expressions and cultural references. Brands should take care making sure how they communicate resonates with locals to build understanding and rapport. Language can make, or break, a localisation campaign.

- Be inspired by local aesthetics: Luxury brands should be inspired by the colours, symbols, images and even fonts that are important to the host culture. They can be used in packaging, logos, stores and on websites. The wrong design choices may be misunderstood (sometimes even offensive) to local audiences whereas the right design will create a familiar and appealing visual identity.

- Make it local: Make changes to the size, shape, material or the functionality of your product to appeal to a local audience’s specific needs and preferences. You may conclude, after research, that you need to create an entirely new range of products to successfully launch in a particular market. For example, think about a luxury fashion brand. The clothing styles, sizes, or materials that would appeal to consumer in the warm climate of Türkiye are unlikely to have the same appeal to consumers in the cold climate of Iceland.

- Luxury service: Perceptions and expectations of customer service interactions differ according to where you are in the world. Luxury brands should familiarise themselves with local customer service etiquette, norms and expectations. Local staff will help with much of this but, if you bring in staff from outside, they’ll need training accordingly. You should also ensure that the local communication channels for customer interactions, feedback and support are easily accessible.

- Get marketing right: The platforms, influencers and commercial partners that work well for you in one country won’t necessarily work well in another. Research those that reflect local consumption habits and preferences most in your new trading location to make your promotional content more engaging and relevant to those customers. Doing so will help a luxury brand more effectively share their story, values and products in a way that appeals more strongly to locals.

Examples of successful localisation by luxury brands

Many luxury brands embrace localisation to increase their chances of success in building their reputation and driving revenue in brand new markets. Below, find examples of how luxury brands have used localisation in different ways:

House of Creed

Since its entrance into the Chinese market in 2020, British-French luxury fragrance brand, House of Creed, has used artistic collaborations to appeal to young, luxury-minded Chinese consumers. The average age of luxury consumers in China is younger than in other parts of the world, and this company is keen to create a demand for its products among this increasingly wealthy and influential demographic. Chinese youth are very fond of social media so much of Creed’s marketing has been focused on connecting through those channels.

House of Creed partnered with Chinese hip-hop artist Benzo to create a new song named “Creed”, an homage to Creed fragrance Millésime Impérial and the brand’s founder. With a strong fanbase on the Chinese social networking app Weibo, Benzo brings a broader audience to Creed’s expanding brand identity. The digital artist FrankNitty3000 created the cover art on the brand’s first music collab. Following the launch of the song, Millésime Impérial became a trending topic on social media in China and the effect has been a boost in product sales.

They also paired up with Chinese toy brand RobbiArt to create a scented designer toy for the Lunar New Year.

Burberry in China

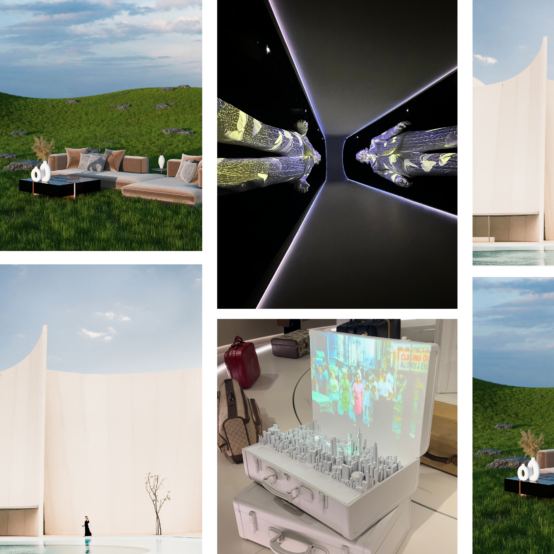

British luxury fashion house, Burberry, launched a social retail store in Shenzhen, China, in July 2020 with Tencent Technology.

The store was a clever combination of the physical and the digital. Its aim was to create and immerse visitors in a personalised shopping experience. Shoppers were presented with the following interactivity opportunities:

- Interactive displays including a living sculpture that responded to body movement.

- Smart mirrors that show product information and styling options.

- QR codes that unlock digital content and services.

Alongside the store was a WeChat mini program that gave consumers access to exclusive content, rewards and other services. The store showcased Burberry’s heritage and innovation in its design. Part of their localisation effort was the opening of Thomas’s Café, based in the store, that celebrated English and Chinese tea culture. Burberry wanted to forge a connection with young and tech-savvy customers in China with the store having identified this audience as an important expansion opportunity.

Gucci

The Italian luxury fashion house launched a series of pop-up stores called Gucci Pin in 2019.

Inspired by the type of pin you’d place on a digital map, Gucci opened stores around the world in locations including Paris, Hong Kong, Seoul and New York. Each store had its own theme and product selection designed specifically to reflect the local culture and customer preferences. For example, the store in Seoul did this with a collection to celebrate the Lunar New Year while the New York store showcased the Gucci Off the Grid collection, a collection made from recycled materials to promote sustainability.

Montblanc

German luxury pen, watch and leather good manufacturer Montblanc also targeted the Chinese market way back in 2009 with its diamond-studded fountain pen called Fortune Number 88.

The pen was designed to appeal to the Chinese culture and values which regards the number eight as lucky. It featured a dragon motif on the cap, a symbol of power and prosperity in Chinese mythology. The pen was limited to 88 pieces worldwide, each priced at $18,888, making it a highly exclusive and desirable item for wealthy Chinese collectors.

Localisation strategies at a glance

General approaches to localisation across the wider fashion sector include:

- Uniqlo: Japanese label Uniqlo uses predictive technology to analyse demand in each local market. Based on the results, it creates bespoke product designs, colours and advertising campaigns for each market to increase brand visibility, localise the consumer experience and optimise stock management.

- H&M: Swedish label H&M succeeds through launching and maintaining heavily localised websites and advertising campaigns in every country they trade in. They use language and culture to provide a localised and personalised shopping experience to connect better with their target audiences. Like Uniqlo, they use predictive analysis to decide on range and stock volumes.

- Zara: Spanish label Zara tries to localise supply chain and store operations in each country as much as possible to become part of the commercial and cultural ecosystem. They focus heavily too on the online experience and drive value through including detailed written product reviews on their websites.

- Louis Vuitton: Louis Vuitton is particularly effective at marrying its global brand identity and values with local market preferences. They make use of local limited editions and celebrity campaigns to build bonds with their target audiences.

Orlebar Brown x VERB Brands

Premium swimwear brand, Orlebar Brown, partnered with VERB to launch Smart Shopping in their target markets. Smart Shopping is a Google Ads feature that allows advertisers to automatically optimise their campaigns based on their commercial goals and live performance.

We overhauled Orlebar Brown’s existing activity, including heavily optimising their ads at keyword level, following an extensive campaign review.

Using localisation techniques, we then rolled out 75 campaigns across 22 markets in three days. As a result, we achieved a 974% return on ROAS, an 84% decrease in CPCs and a 50% increase in sales for Orlebar Brown.

Get in touch

To drive new sales and engagement in other markets, please get in touch with us. Let us know the markets you want to expand into or improve in and we’ll share our thoughts and experiences with you. To contact us, click here.