Modern Affluence Summit 2023 – Our Top Takeaways

Reading time: 6 min

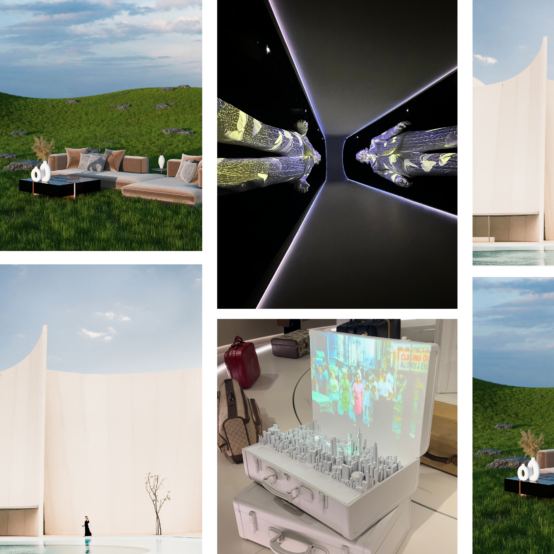

Earlier this month we joined forces with the brilliant Adoreum & Modern Affluence teams as event partners for their annual summit. The day was fuelled by some incredible insights from world-leading brands and businesses such as Bentley Motors, Tag Heuer, Bloomberg, De Beers and Maybourne Hotel Group to name a few. The 2023 Summit theme was around The Great Wealth Transfer which aligns perfectly with our annual VERB report the State of Luxe, where this year our proprietary data looks at Attitudes to Wealth, specifically those of the affluent and HNW consumer. VERB’s Business Director Sarah Keeble took to the stage to dive into some initial findings from our 2023 data.

We’ve noted our favourite talks and provided an overview of our top insights and takeaways from the day below.

The Global Wealth Blueprint – Bloomberg

Bloomberg Media took us through some recent insights from their Global Wealth Research programme, seeking to explore the changing financial and investing needs of investors in the context of the current financial landscape. The research dives into the changing needs of the high-net-worth investors, to gain a better understanding of how they are diverging from the needs of the general population. Our key takeaways include:

- Stock markets & equity are the biggest contributors to the wealth of Gen X HNWs

- Nearly 80% of both generations believe that AI is going to have a positive impact on investing

- Millennials expecting more personal finance through investing, Gen X expect AI to automate tasks (portfolio monitoring)

- Holistic wellbeing on the rise since CV19 – the modern affluent are now prioritising health & relationships and balancing work

- 95% of HNW personal values are impacting their investment choices in 2023

- Gen X are the most likely to be aware of ESG investing and participate

- For brands to connect with modern affluent, they must prove authenticity whilst also disrupting business with purpose.

- What are the main attributes driving trust amongst the HNW? Purpose beyond profit, disrupting business, thought leaderS, authentic actions, innovation, commitment to ethical & sustainable initiatives and practices

Future Growth Opportunities for The Rising-Wealth-Generation

The landscape of wealth is undergoing a transformation, as the next-wealth-generation embraces a distinct set of values and exhibits heightened awareness of the world’s pressing challenges. In this engaging session, the panel featured Michelin star Chef Adam Handling, Paul Clements-Hunt (Director, Mischon Purpose) and Veronica Chou (President, Novel Fashion Holdings) who are revolutionising the conventional approach to brand strategy and innovation, seeking sustainable profitability and enduring share price growth.

See below the top themes covered in the panel discussion:

- The importance of engaging in initiatives that support environment, social & climate

- Circular economy enterprise

- Sustainability into regeneration

Great Expectations Panel x The Future Lab

As the globe flirts with recession, there’s one group, extreme-affluents, who will likely be unaffected. While retail sales have been falling, spending on luxury goods and experiences grew by roughly the same amount in 2022 with last year’s boom in the €1.38tn market being driven almost entirely by Gen Z and Y, who dominated the personal goods market (including luxury clothing, bags, jewellery etc). And this is set to continue according to Bain who believe spending of these generations is likely to be three times higher than any other by 2030.

So, with this top 5% accounting for nearly 40% of the overall luxury market sales, how are brands courting these individuals to build robust client communities which are attractive enough to retain these relationships and address the complexity of resonating with up to 5 generations of individuals? And crucially what will trickle down to mass-affluent segments.

We loved the energetic panel for this discussion, featuring Barbara Hans (Chief Marketing Officer, A Lange & Sohne), Esther Oberbeck (SVP Group Strategy, De Beers) and Rebecca Burdess (Global Head of Guest Experience & Services, Maybourne Group).

- Maybourne Hotel Group – the global hospitality group are leading on creating symbiotic relationships to understand who their consumer is and serve them at their best. Connectivity and community is important to engage with their younger generational clients.

- Across the 3 brands on this panel, we saw a unified purpose of striving to enrich people’s lives

- De Beers introduces the world’s first blockchain-backed diamond source platform at scale – with more end clients wanting to know the source of the products they buy, the deep meaning associated with a diamond purchase requires a technological step-change to meet their expectations.

- The connection between retail and marketing is now becoming one ecosystem. The retail landscape is evolving. Success at the shelf is no longer about the depth and breadth of inventory, but rather creating engaging experiences for customers.

- Transformation not reinvention

- The importance of innovation – LVMH don’t sell product they sell cultural influence

Future Laboratory Report

The Future Laboratory unpacks this moving landscape of emotional and rational drivers of change to help us better understand why the Great Wealth Transfer is a signpost for transformation, and the generation that will be responsible for it a breath of fresh air in the current world of populism and profiteering at all costs.

We dive into the recent report released in collaboration with the Modern Affluence Summit and have highlighted our key need to knows below:

- Surveying the wider landscape, of which HENRYs (High- Earning, Not Rich Yet) and Modern Affluents are a part, we also need to take into account the changing fortunes of Gen Z, Millennials and middle-aged Gen Xers and understand that their current control of the world’s wealth, which sits at a meagre 3%, is about to reach a significant 60%, while Gen Z and Millennials in the US alone, will be handed a staggering £42 trillion ($53 trillion, €49 trillion) by 2045.

- Gen Z are equally proactive when it comes to researching their luxury brand, whether this is about uncovering their back story – greenwashing or questionable business practices. In the US, Forrester Research found that 51% of Gen Z ‘citizensumers’ did this as a matter of routine.

- They are also using their digital-first skills to make investments that enhance their wardrobes and wrists, as well as their bank accounts. Gen Z are adding pre- loved or archival pieces to their portfolios in the same way that older Millennial collectors have done.

- The pre-owned market – a place very few HNWI consumers were keen to venture into because of its negative associations with second-hand and worn five years ago – has now become a key way for Gen Z and Millennials to demonstrate their circular and environmental principles.

- According to The RealReal’s 2023 annual Luxury Consignment Report, Gen Z are by far the most active investors on the platform, with sales and purchases of luxury items purchased by Gen Z up 50% in 2022 alone.

- Investment, then, for Gen Z especially, comes with a completely different mindset than that found among older generations. It is digital, fractional, collaborative but, as with all Gen Z mindsets, it must come with sustainability, purpose and impact as part of the package.

- Luxury brands are also shifting donations to ESG initiatives. A pioneer in this field, Prada, first launched the Sea Beyond in 2020, a marine preservation action recently supplemented with a literacy programme striving to support scientific research.

- Finally, as to the future, they are currently looking to AI and quantum to provide them with the next entrepreneurial journeys, not to mention sentient financial service advisers.

- Health, wellness, and wellbeing have also become part of their investment strategy. Referred to as their ‘healthworth’ rather than their network, it is a growing area for them to focus on, and invest in – think biotech, cellular and life sciences.

State of Luxe: The Affluent Consumer & Perceptions of Wealth

As partners of the summit we provided an exclusive insight into our upcoming State of Luxe 2023 report – our annual deep dive into the state of the luxury sector and how affluent consumer behaviours around wealth are shifting.

Head over to our Insights page to discover and download the full discussion.