Luxury resale: Gen Zers and their attitude towards luxury items

Reading time: 5 min

Growth in sales of pre-owned luxury items have outpaced growth in the sale of new items for a few years.

Secondary markets for watches and jewellery have existed for decades. But recent times have seen the growth of similar markets for a much wider range of designer items ranging from pre-owned designer handbags to fine jewellery.

A number of factors have contributed to this, particularly:

- Luxury goods owners wanted to trade their assets for cash, particularly in the aftermath of the Great Recession.

- An increasing willingness among buyers to purchase second-hand luxury goods.

- Major supply chain issues caused by the COVID-19 pandemic.

For many, the most surprising contributor to the growth of the luxury resale market is also the very latest – demand from Gen Zers, currently the smallest cohort of luxury goods buyers (about 4% of the market).

The values Generation Zers supposedly embrace

Gen Zers (born in the last 90s/early 00s) are, at the time of writing, mostly in their early 20s at the very beginning of their career.

Through no fault of their own, Gen Zers have been wildly mischaracterised by pollster and politicians in recent years.

Surveys suggest that Gen Zers are more spiritual and less materialistic and ostentatious than previous generations. They look for meaning in their lives and their work. They’ll only spend with companies that share their values and demonstrate their authenticity through ESG and CSR programs.

The luxury goods market may, on the face of it, sound like it would be of very little interest to them.

Luxe Digital, in a recent article, explain with piercing clarity why the desire to own luxury goods, albeit pre-owned items, is entirely consistent with the Gen Z worldview, citing

- Sustainability. Quality items can have a second life with a new owner and not throwing them away stops them from adding further landfill.

- Digital. Most resale markets are online and offer customers a hassle-free online shopping experience. They are also satisfied with current schemes to certify pre-owned items as genuine.

- Save money. Gen Zers’ have constrained budgets. But they perceive the future resale value of quality pre-owned items as high. They save money and have something of value to sell at a later date.

- Collectability. Gen Zers and other shoppers have the chance to purchase sold-out streetwear, limited-edition releases, vintage items and previous season collections which have or may become especially collectable at a later point.

How luxury brands have reacted to Gen Z’s interest in luxury resale

Luxury brands have taken a very broad-minded and far-sighted attitude to the growing market for a broader range of pre-loved luxury items.

Speaking to VERB Brands’ clients about it, typical feedback included:

The existence of this market is an implicit acceptance by Gen Z of the added value in luxury items

At an emotional and intellectual level, Gen Zers accept that luxury items exist in a different space than mass-market items. Like fine art or limited-run designer pieces.

They can see the value beyond intrinsic utility. They appreciate craftsmanship, scarcity, design vision and skill in assembly.

First-time ownership and a stepping stone to their next luxury purchase

Brands hope that if, for example, a Gen Zer picks up a second-hand Louis Vuitton and she adores it it, she may develop loyalty to that brand for decades to come.

But that’s just the start. Gen Zers might want their second, third and fourth luxury pieces to be bigger and better. Each new purchase makes them one step closer to having a life-long attachment to luxury. It’s similar to how people buy bigger houses and cars as they get old because they have the income and they believe they’ve earned it.

Future value is important to Gen Zers. It’s not yet as important to Gen Zers as it is with Millennials and Gen Xers but it’s nearly at 50%.

And it’s that future value in a first purchase that opens the door to the next one. For example, the FarFetch Second Life program allows customers to trade in their used designer handbags (selected brands at the moment). They’re then credited with an amount they can use to shop to buy designer handbags from the current season.

So, in her quest to own the pre-loved designer bags she adores, a customer could trade in her current Christian Louboutin for a brand new Christian Dior with FarFetch.

A wholesale rejection of luxury fakes

Luxury fakes are a problem that will never go away. But Gen Zers are much happier to spend far more buying pre-loved pieces than Millennials or Gen Xers were.

Pre-loved items sit perfectly between the desire for sustainability and authenticity.

Many Gen Zers require both of these qualities to be extant before making a purchase. And if a verified second-hand reseller or resales site can give them the assurance they need, they win the sale.

Gen Z knows there’s no such thing as a “luxury garage sale”. They’re not interested in buying fakes, knock-offs, or from online consignment stores where they can’t be sure what they’re getting.

What the future holds for the luxury resale market as Gen Z gets richer

Luxury brands’ approach

Many luxury brands and fashion industry leaders are currently exploring what opportunities this market has for them. Many have already made a move, an example being Alexander McQueen. They recently partnered with luxury resale site Vestiaire Collective, part of its “Brand Approved” program.

However, analysts at Bain & Co reported that brands were having difficulty putting together their own resale propositions in its 2021 Consignment Report. The issues challenging them the most were setting buy and sell prices for pre-loved items, initial stocking levels, routes to market and on branding issues.

Ben Hemminger, CEO of luxury reseller Fashionphile, told Fox Business that all luxury brands will eventually get into the secondary market through trade-in or trade-up programs (similar to high-end mobile phones) or by partnering with recommerce firms like his.

Where investment in the sector is coming from.

Investors poured $134 million into luxury resale platform opportunities between April and August 2020. Market leader The RealReal has raised $185m to grow its business in the past three years.

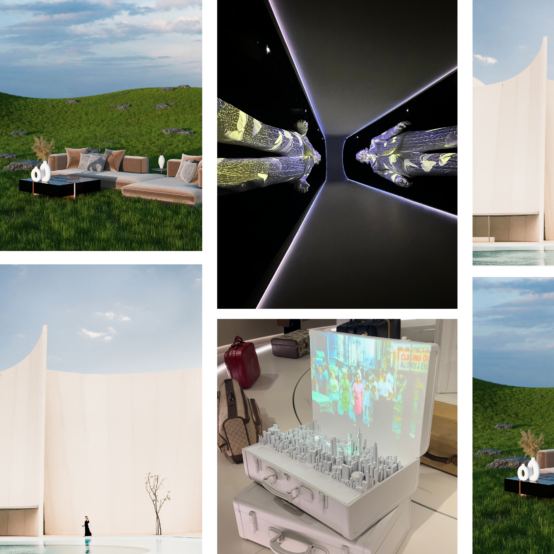

While they work out what role they want to play in the luxury resale market, brands’ involvement in the market seems mainly limited to direct investments into the best designer resale sites like GOAT, FarFetch and Grailed.

Online only, no shops required?

This is the first generation whose interactions with companies are almost exclusively carried out via social media and the web. Many Gen Zers avoid, if possible, going into physical stores, much preferring shopping online.

On the face of it, retail store count will be unimportant to Gen Z because they don’t seek an in-store experience. Not everyone agrees with this – luxury UK resale firm Designer Exchange is currently busy building its own retail network. They see a clicks-and-mortar future for luxury resale.

But most of the fight for business will be online. This means that luxury resales sites will be taking on brands and established retailers for prime search engine real estate. We should expect to see pay-per-click costs pushed up for the entire sector in the coming years.

We think there’ll be two types of resale stores online – superstores and niche suppliers.

Expect superstores to position themselves as home to the most convenient resale services. A one-stop shop for pre-used beloved luxury brands.

We also expect to see retailers going niche with some concentrating on pre-loved items from top fashion brands while others focus on the finest luxury in home decor.