What Does the New Payment Request API Mean for eCommerce Sites?

An eCommerce merchant is responsible for ensuring that everything works seamlessly so that its customer enjoys a smooth path-to-purchase through an easy transaction and has no complaints to ensure the user comes back again to make another purchase.

eCommerce brands are on the lookout for new ways in which they can surprise and fulfil their users to make them happier. Offering more payment methods is one way to help to cater for different customer preferences and thereby can help to increase the chances of picking up a sale, but every payment method offered needs its own support; the varying payment methods available may work very differently from each other and so require totally different backend provisions.

To make life even more complicated for e-commerce merchants, each of these payment methods has different requirements in terms of what the customer has to do.

For example, paying by card requires the customer to provide their 16-digit card number, expiry date and three-digit code from the strip on the back of the card. On the other hand, paying by PayPal does not need these details, instead, it only requires the customer’s email address and PayPal login information.

It is also worth bearing in mind that mobile devices are rapidly becoming the internet-access devices of choice for increasing numbers of people and yet they are far more cumbersome than old-school desktops and laptops when it comes to entering information.

In principle, merchants can use tools such as autofill to help them, but there is a limit to how much these tools can be used due to the need to maintain security.

It is therefore hardly surprising that customers can struggle with purchase forms on mobile devices. Even though there has been an increase in usage of mobile devices, this did not reflect a corresponding increase in e-commerce sales via mobile devices.

On top of that, the rate of cart abandonment for purchases begun on mobile devices is much higher than that for desktops/laptops. We explain what is the new Payment Request API and how it will affect eCommerce sites:

What is the Payment Request API?

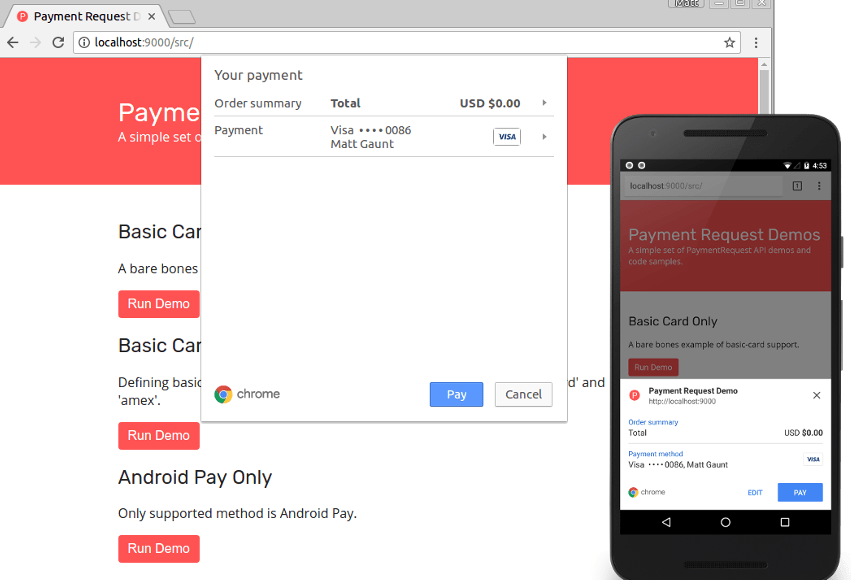

The Payment Request API is a universal checkout process that is meant to avoid having checkout forms on eCommerce sites.

Essentially, the Payment Request API is a way of making the payment process a lot more streamlined, with the browser acting as a middleman between the payment supplier and the merchant, providing a much easier checkout process for the customer.

It is not a new payment method, instead, it collates the user’s data, including payment and shipping information that is stored in the browser, so that payments can be processed with a single click.

In a Payment Request transaction:

- The e-commerce site makes a payment call to the API, as part of which it indicates which payment methods it supports.

- The API then contacts the merchant, checks which payment methods they support and presents them with a list of payment options tailored to their preferences.

- The customer then chooses their payment method and provides the necessary details to authorise the transaction, plus, if necessary, any further details the merchant needs to complete the purchase transaction.

- The API then returns this information to the eCommerce merchant to finalise the sale.

From the customer’s perspective, they enjoy a smooth, customised experience and from the merchant’s perspective, the Payment Request API takes over much of the hard work of managing the payment.

How will this affect eCommerce sites?

From an eCommerce merchant perspective, it allows them to leverage different payment methods without having to liaise with every single one of them and avoiding having several different forms for each payment method. It will also standardise the payment communication flow as much as possible which will help improve conversions in both desktop and mobile.

The Payment Request API can benefit both, retailers and customers. It is a much safer way to make an online transaction due to Google Pay’s card tokenisation which reduces the risk and exposure to fraud. Retailers are also likely to see a huge decrease in checkout bounce rates due to the process being much simpler to complete. There is an opportunity for customers to save gift cards, loyalty cards and special offers, almost like a virtual wallet, which will allow an increase in customer’s overall brand loyalty.

If you want to find out a more in-depth explanation of how the new Payment Request API works, please check here.

The post What Does the New Payment Request API Mean for eCommerce Sites? appeared first on Verb Brands.