Luxury Digital Trends 2023: Looking ahead

Reading time: 8 min

Luxury Digital Trends 2023: Looking ahead

As experts in catering to the affluent and HNW consumer, we’re constantly looking ahead to significant shifts in audience behaviours, luxury industry trends and forecasted digital advancements to stay ahead of the curve for our portfolio of clients.

As the new year has quickly dawned upon us our teams have shared our top predictions for the luxury industry and some key recommendations when looking at how to reach and engage the top 1% and ensure brand relevance. With predictions of an economic downturn which is likely to impact the wider digital industry, we all know that luxury brands have fantastic resilience in these times and arguably thrive. 2022 saw 95% of luxury brands enjoying a positive compound annual growth rate.

Within the following article we uncover the top luxury digital trends and recommendations our VERB team have forecasted for the year ahead.

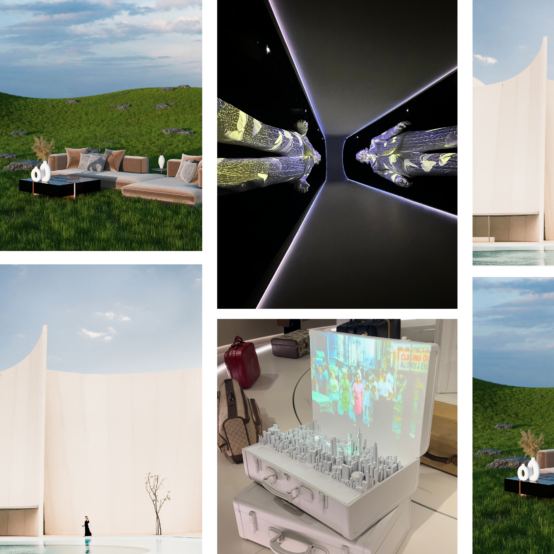

Our top 5 Luxury Digital Trends 2023

1. Connection through values & ownable storytelling

Mainly what we’re seeing is a redefinition of value. New Luxury isn’t about price, it’s about culture, community, the values we share, and aligning ourselves with brands who can help enhance that worldview.” Jian DeLeon, Editorial Director of Highsnobiety & Author of The New Luxury, Defining Aspiration in the Age of Hype.

We love this quote from DeLeon as it summarises the shifting nature of how we define and categorise Luxury as a term, but also as a sector. Ultimately, the essence of luxury remains: to drive additional value for its consumers. What is changing is how value is created and what the drivers of said value are.

Jing Daily recently stated that ‘While traditionally exceptional craftsmanship and service were the byword for luxury, these are now simply expected, in other words priced in. No brand will get any credit in 2023 and beyond for being friendly or providing high quality’. These previously defining luxury factors are now merely what we call “hygiene factors.” If your brand does not provide it, it will be irrelevant. But it’s not a significant value driver anymore.

The shift in the definition of what Luxury means is largely guided by the ‘next gen’ customer and the qualities they look for in a brand. Where luxury was once about aligning oneself to social class and status, a key driver is individuality and belief systems. This is why audiences are becoming much more tribal and nuanced. Tribal identity can be made up of how one presents oneself, but largely speaking goes deeper. It’s about brands standing for the personalities of the community. Of being understood. This is why marketing leavers such as human content, community management and circles of influencers are powerful to help a brand tap into and play a part in a tribe’s life. There are 3 fundamental considerations that help shape how we understand and strategically implement the levers we want to communicate to audiences through a marketing campaign.

(Source: VERB Brands)

2. Emphasis on loyalty

In today’s digital era, brands are evolving the ways in which they connect with their audience, on a more personal level. A number of luxury brands are harnessing the idea of ‘convenience through technology’, exploring ways to connect with the affluent consumer in a personalised manner. With more customers shopping on digital platforms than ever before, it’s imperative that brands find innovative ways to leverage technology to bridge the gap between in-store and online, provide exceptional clienteling, and deliver a truly immersive omnichannel experience.

We’ve seen luxury brands play into this with an increased sense of energy behind VIP strategies. For example:

Whatsapp – Many client advisors are using such platforms to enable direct dialogue and create commercial hooks that ultimately trigger an in-store experience or remote sale. “This is becoming a new normal in the selling ceremony,” comments Federica Levato, a Milan-based partner at Bain & Co.

Some luxury brands already use WhatsApp informally: Burberry, in English-speaking countries, allows online shoppers to initiate a WhatsApp chat to get advice on styling, gifting, sizing, order tracking, returns and aftercare. Yoox Net-a-Porter’s personal shoppers swap voice notes and screenshots with customers, while in some markets, the company uses WhatsApp for delivery updates, says Vogue Business.

Subscription and loyalty models – A luxury retail CRM system not only makes it easier for customers to keep track of their points and reward eligibility, but also for luxury retailers to identify high-value customers, trigger automated real-time loyalty messaging, and provide a more tailored engagement.

(Source: Hubspot)

3. Effectiveness of Brand Collaborations

Collaborations to build association & drive perception, maintain relevance, and reach new audiences are at an all time high.

As a 2023 ‘box-fresh’ example, Nike x Tiffany & Co. has caught the attention of global media as this marks their first-ever collaboration, despite Nike’s 2005 Diamond Supply Co and Nike SB Dunk being inspired by Tiffany’s brand colours this is Tiffany’s first time stepping into the world of footwear. The jewellery brand attempts to tap into the younger consumer by creating a more accessible image, having previously collaborated with artists Jay Z and Beyoncé.

(Source: Tiffany & Co. x Nike)

In September last year, Tiffany & Co. collaborated with Fendi to unveil Fendi’s iconic Baguette bag’s 25th anniversary. The Fendi bag was made popular due to its cameo on popular television series Sex and the City. Another powerful move to become highly relevant amongst a fashion conscious market of consumers.

At the core, effective brand collaborations can be used to:

- Build association and drive brand perception

- Maintain industry relevance

- Reach new audiences

4. Conscious Consumption

More than ever, brands are focusing all efforts on having a clear synthesis of what they stand for, for customers and the wider world. This includes a statement of intent and actionable improvements in order to have a positive affect in the functioning and impact of a business.

When it comes to conscious consumer consumption, as highlighted in our recent State of Luxe 2022 report, the more digitally engaged the affluent consumer, the more they voiced their want for brands to be championing social values such as sustainability, environmentalism, ethical practices, charity, and equal rights. It is worth noting that this research was conducted following the 2020 Black Lives Matter (BLM) movement, raging forest fires in Australia, and the pandemic pushing many people to reevaluate their own personal values amidst lockdowns. Our research pointed to the fact that social media was a key platform for conversations surrounding such current affairs, such as BLM, and it was this collective narrative that was impacting consumer behaviour, brand favorability, and purchase decisions. Affluent consumers were more willing to pay for brands adopting these characteristics.

(Source: Pangaia)

5. Digital disruption with Blockchain technology

Blockchain allows retailers to enhance their operational efficiencies while providing consumers with the authentic provenance information of luxury products. These lead to benefits for luxury brands such as stronger customer satisfaction, reduced disruption time, enhanced brand value, and stronger data protection all round.

Louis Vuitton, Moet Hennessy (LVMH), Prada, and Cartier joined forces to create Aura Blockchain Consortium, the first blockchain system focused on providing a platform for tracking product history and proof of the authenticity of luxury goods. This is a significant step for brands investing in technologies and innovative thinking to bring the customer experience to a new level and build a virtuous future for the luxury industry.

NFT Hype slowdown but brands still exploring

Over the past year, NFTs emerged as a promising new avenue for fashion brands to draw in customers and build membership communities, letting them interact in ways that are arguably deeper and more meaningful than an email address.

Whilst 2022 saw the inevitable growth of the NFT market, many luxury brands have continued to pursue the launch of NFT collections to keep consumers enticed.

“Many luxury brands have chosen to launch limited edition NFTs in order to satisfy the consumer hunger for the next trend: an ironic twist for an industry that promotes tangible goods at its core to drive market appetite,” Sarah Beaumont (Baker Botts) tells Business of Fashion.

(Source: Porsche)

Arguably not every luxury brand has succeeded so far in the development of digital artwork, after weeks of hype, Porsche’s first NFT collection wasn’t as triumphant as anticipated by the German automotive company, achieving a 16 percent sell-through rate. Jing Daily provides all you need to know here.

Our New Business Director, Sarah Keeble comments “There is a market for NFTs but there needs to be a purpose behind them – consumers can see through a press stunt or piggybacking a trend. NFTs peaked because there was a get rich notion attached to them and Luxury were well placed to play into this phenomenon. Now with the NFT market crash, HNW are sceptical. NFTs still play an exciting role for the gaming world – particularly for the fashion sector. Where we also see a potential growth is in the authentification market for luxury products. Blokbar are making exciting waves here for the premium drinks industry. Watch this space.”

Our top 3 predictions and recommendations for Media 2023

VERB Paid Media Strategy Director, Vickie Cooper-Samios, details our predictions for the media trends we’re likely to see within the digital media industry this year.

1. Navigating Search in 2023

VERB predicts that 2023 is going to see substantially higher CPCs in the luxury vertical whilst brands capitalise on the economic environment. Automation will be key to ensuring brands get the very best cost efficient performance.

We believe by the end of the year; keyword match types will be a thing of the past. This proves troublesome for luxury retailers where the audience profile and intention behind a search query can be vastly different, but where the search behaviour remains the same as the wider retail industry. The key to success is to ensure brands carry out risk prevention and start working with a modern search approach, feeding the machine as many signals as possible to ensure it’s working efficiently when those match types are no more.

2. Collecting First-Party Data

Whilst it feels like we never stop talking about first party data in the industry, this is the future and it’ll be even more pivotal to luxury clients. Whilst there are further delays to a cookie-less world, which is now set for H2, luxury retailers often have smaller customer databases to work with yet the need to understand their audience profile is greater. Utilising first-party data to re-engage whilst competition is fierce in 2023 and creating lookalikes for new customer acquisition is key for success.

3. Increased Focus on Creative

Across many digital platforms in 2022 we saw creative become the main deciding factor in ad auctions with other key elements to ad auction success playing a smaller role. As auctions get more competitive, creativity will play a much more important role in both gaining strong ad positioning but also ensuring you’re reaching out to the right audience over your competitors.

Get in Touch

If you have any questions about our digital trend predictions, our expert team would love to hear from you! Please get in touch via our contact form.