The Future of Luxury in 2022 | 8 Things to Take Away from the Walpole British Luxury Summit

Monday 6th September saw 300+ senior marketing professionals gather from all over the UK for the Walpole British Luxury Summit. VERB is a partner of The Walpole, the official luxury body for British Luxury, and last year spoke at the 2020 Summit. This year, however, we were simply attending. The event was a full day’s program with speakers from the likes of Harrods, Roksanda, Farfetch, and Bain & Co. Research was presented, future trends were uncovered, and challenges were addressed. VERB’s New Business and Marketing Director, Sarah Keeble gives you 8 key things to take away from the event.

1 Ethics over aesthetics

Sustainability was, unsurprisingly, a huge topic throughout the day. The initial session looked at the top luxury predictions for 2022, and put sustainability and climate change as a top 5 priority for the industry. In another session, Bain & Co backed this up with research showing consumers are now, more than ever, valuing brands based on their sustainability, diversity, ethical practices, and inclusion. These values are expected, crucial and, pun intended, not a luxury for brands to have. This matches up with our own State of Luxe research we commissioned last year with our partner GWI; we saw the importance affluent consumers put on these values, and they are willing to pay more for brands/products that demonstrate these values. Brands are starting to get their houses in order, but ethical and sustainable practices need to be communicated and backed up by proof. The customer wants to be educated, and they are listening.

2 Human connection playing a big role in brand advocacy & loyalty

Perhaps unsurprisingly, human connection is growing in importance for luxury consumers post-pandemic. Whilst a personalised human approach has been at the centre of the luxury sales in-store experience, now, post-pandemic, human emphasis is offline and online. Facebook shared how various brands are creating one on one human experiences through their Facebook messenger feature, as well as through Whatsapp. The emphasis is on communicating with segmented groups and even on 1 on 1 with VIP customers. This too, is how WeChat and various other consumer platforms work in China and sell high volumes of luxury products… watch this space.

3 Second-hand luxury is rapidly growing

Or as Bain & Co put it “Second Life of Luxury”. They mentioned the growth in the demand for rental and second-hand luxury is huge and will only continue to grow. This lends to the growing emphasis on sustainability and how brands can create a more circular economy. We have already seen the success of Vestiare Collective and rental platforms have boomed this year. Brands should be considering how they can get involved in this space – for example providing rental options. VERB recently support Lymited in its launch too, a new consignment platform for unique limited luxury products. This market will only continue to grow.

4 Social commerce is growing… rapidly

According to Facebook, social media is becoming a key shopping platform for luxury as shopping habits evolve. Their research states that 54% of luxury consumers used social media to shop for the first time during the pandemic. Furthermore, Luxury consumers shop on social media 3.3 x more than the average non-luxury consumer.

Speak to our social media team about how to maximise your social commerce.

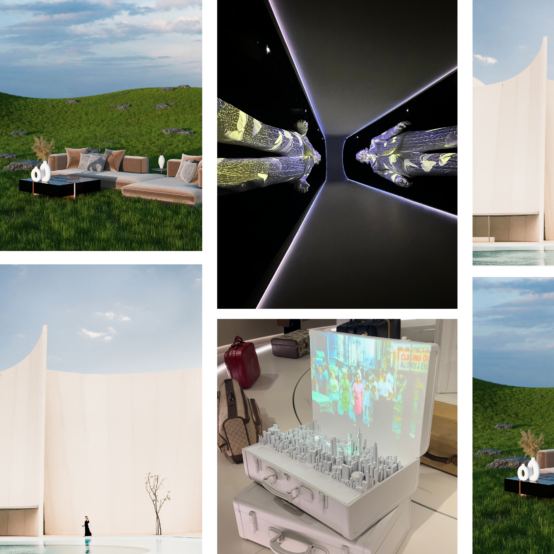

5 AR (Augmented Reality) & VR (Virtual Reality) supporting luxury shoppers purchase

According to Facebook, 21% of luxury shoppers have used AR/VR devices before, 14% have already used AR/VR to make a purchase or explore a product. Furthermore, Luxury shoppers are 1.9x more likely to desire an in-store experience and 2.2x more likely to want innovative technology such as AR/VR to experience products. We’re loving Gucci’s virtual trainers and Chanel’s AR lipstick experience as a few great examples of luxury brands who have tested this space but the possibilities are endless.

6 “Localisation is the new globalisation” – Anya Hindmarch

Founder, and Creative Director of her own brand, Anya Hindmarch is the epitome of a British luxury success story. She spoke about how her business has, in the past, prioritised global commerce with over 57 physical stores across the world, to now, where her focus is on creating very local experiences for key markets. She emphasized how with a localised approach you are able to deliver luxury store experiences on a cultural level. She has recently launched the new and admired Anya’s Village; a true luxury experience with a brand-led cafe, hairdressers, and bespoke lab to customise her handbags. Whilst this focus was on physical retail, we have been working with brands to take a more localised approach to digital marketing. Get in touch to find out how we do this.

7 Chinese spending is going to be repatriated – perhaps irreversibly

Adam, Co-Founder of Tong, Chinese Marketing Agency, spoke about five trends for China. A key trend worth noting is the repatriation of Chinese spending. In 2020 the EU saw a 75% drop in Chinese consumer spending, meanwhile, China saw 54 billion spent in luxury sales in 2020, 48% increase from 2019. Whilst the pandemic plays a big part in this shift of where the Chinese customer is buying luxury, there are concerns that EU levels of spending will not bounce back to pre-pandemic levels. With the Chinese no longer able to claim back tax on luxury items they have bought here in the UK, the desire to come to London to buy luxury is dampened. Furthermore, the ongoing pandemic could see travel continue to be limited/restricted from China. Another thing to consider on top of that is the political climate in China seeing the country become more isolated… the advice from Tong; be sure to have a presence in China, rather than cater to the Chinese customer in the EU/UK.

8 Luxury brands need to lean into DNA to disrupt

A favourite session of mine, Nader, from the London Business School spoke about how luxury brands’ creative approach is so often the same. Giving examples of the fragrance, jewellery, watch, champagne, and make-up sectors, Nader pointed out that luxury needs to stop copying each other! Instead, brands should lean more into their DNA. He mentioned focusing on the story of the brand: the founders x the place and era x the purpose and act of creation x the audience. Speak to our creative team if you’re interested in disrupting your sector with creative that will make heads turn, rather than a carbon copy of your competitors.