NFTs for the Luxury Sector

Luxury NFTs could become a $56bn a year marketplace by 2030, according to investment bank and financial services leader, Morgan Stanley.

Interest in NFTs has risen sharply in the last 12 months as can be seen by the Google Trends chart below…

Searches for the term “NFT” were virtually non-existent up until around February 2021.

Since then, according to Ahrefs, 968,000 searches for “NFT” are now made every month in the United States with 133,000 searches occurring in the United Kingdom.

NFTs are attracting significant attention from luxury brands with some commentators speculating that NFTs will transform the “luxury” market and the definition of “luxury” itself.

In this report, we review developments in the NFT sector to date and speculate what the next 12-24 months might bring for the luxury sector.

What are NFTs?

NFTs are a digital record of the ownership of an asset whether digital or physical. The record itself is held on the blockchain (more on that later).

The type of asset whose ownership is most commonly recorded with the purchase of an NFT is currently art (music, video, imagery, text, and so on).

But the concept of “ownership” in the world of NFTs means something different to the widely understood legal definition of “ownership”

The owner of an NFT does not necessarily have legal title to the copyright in the intellectual property contained within the asset associated with their NFT unless it is specifically transferred in the sale and purchase agreement.

If a company seeks to commercially exploit the intellectual property in an asset associated with an NFT, the creator may have the legal right to sue the company for damages if they didn’t surrender the relevant rights as a condition of the transaction.

There is also nothing to stop the creator of a digital or physical item previously sold via an NFT from making multiple further copies of it and selling new NFTs for each copy made.

The digital files associated with an NFT are easily transferable between people – the very same thing which wiped destroyed the value of music publishers and movie studios in the era of Napster.

As original NFT creator, Anil Dash wrote in The Atlantic, “when someone buys an NFT, they’re not buying the actual digital artwork; they’re buying a link to it.”

It’s clear that the value of NFTs cannot be measured in using conventional economics.

So why is there such excitement around NFTs and what have luxury brands seen in NFTs that had made them interested in moving into this growing sector?

Bitcoin and the pandemic

Let’s start with some context.

As mentioned earlier, NFTs are held on the blockchain.

Blockchain is distributed ledger technology that records the ownership (and changes of ownership) of cryptocurrency.

These ledgers are held simultaneously on thousands of servers around the world and are subject to constant updating.

These ledgers are publicly available and can be cross-referenced against each other for accuracy.

It’s this transparency that, in part, gives cryptocurrency its value.

Blockchain is secure by design and, although not impenetrable, its veracity is trusted by cryptocurrency users.

In 2017, the value of Bitcoin and other cryptocurrencies rose dramatically. Although prices dropped significantly over the following two years, it recovered those losses and now regularly hits record highs.

Institutions as a result began investing in cryptocurrency.

Wealthy and high net worth individuals followed as they sought to profit from both the rise in prices and by hedging against its volatility.

Bitcoin even became one of the official currencies used in El Salvador.

In March 2020, the world began to shut down as governments battled the COVID-19 pandemic.

Money continued to flow into cryptocurrencies during the pandemic.

One problem with cryptocurrency is that it’s difficult to spend unless it’s converted back into fiat currency like the US dollar or pound sterling.

Tens of billions of dollars in value were now stored in Bitcoin, Ethereum, and other cryptocurrencies with nowhere to go.

At the same time, artists had suffered for nearly a year because they couldn’t perform to the public because of lockdowns.

Eager to recoup some of their losses, they looked to different ways to make money. Many of them focused on creating artwork which they could sell as NFTs (the first example of such a sale was in 2014).

NFTs can only be purchased using cryptocurrency and it used the blockchain already trusted by cryptocurrency holders.

Cryptocurrency holders really bought into the idea of NFTs.

A wall of money then began piling into the sector. $100m of NFTs were sold in January 2021 – $25m of music-related NFTs the following month.

NFTs, the Metaverse, and Bored Apes

Sales of NFTs continued to rise exponentially throughout 2021.

Concurrently, the buzz around the metaverse was beginning to build – metaverses are 3D worlds powered by the internet allowing a new form of visual and virtual social connection.

Rumours began to surface in around April that Facebook were creating their own metaverse to compete with metaverses being created by other developers.

Soon after in September 2021, Facebook changed their name to Meta and announced their plans to dominate this space.

Check out the Google Trends graph below for searches for “metaverse” to see the stir caused by the announcement:

One month before Facebook’s announcement, 101 “Bored Ape” NFTs offered for sale at Sotheby’s in New York fetched $24.4m.

10,000 of these computer-generated Bored Ape NFTs were brought into being by its creator – at the time of writing this article (January 2022), one NFT has resold for $1.64m and, in the last 30 days, the cheapest sale from this collection was just below $206,000.

Bored Apes have recently been purchased by the likes of Jimmy Fallon, Post Malone, Steph Curry, Logan Paul, Shaquille O’Neill, Gary Vee, KSI, and rapper Eminem who reportedly paid over $400,000 for one which he thought looked like him.

In October 2021, before price inflation really took hold in the sector, Adidas reportedly bought a Bored Ape NFT for 46 Ethereum, equivalent to £150,000.

Teaser images have since been released of a Bored Ape wearing adidas clothing.

Analysts believe that, given the popularity and desirability of the “apes” in the collection, adidas will use their Bored Ape as an online social media influencer and a Metaverse avatar for the brand.

The value and size of the NFT market

According to Cryptoart.io at the time of writing, the market capitalisation value for NFTs is $2,515,429,385.45. Check out their list of most expensive NFTs purchased here.

And the number of buyers able to easily purchase NFTs is going to get a lot bigger soon.

Coinbase is one of the world’s leading cryptocurrency exchange platforms and they’ve just announced their plans to launch a rival platform to OpenSea, the world’s largest NFT marketplace with over 225,000 monthly users.

Soon, 73 million Coinbase users will soon be able to participate in the NFT marketplace. Analysts predict that this might further push up the price of NFTs to previously unseen levels.

NFTs as a pass to exclusive events in the Metaverse

Adidas were perhaps the first international brand to understand how NFTs and the Metaverse could be used to create a sense of exclusivity around their products.

The company teamed up with Punk Comics, gmoney, and the Bored Ape Yacht Club to launch their own NFTs as part of its new “adidas Originals” marketing campaign.

In November 2021, the company sent “adidas CONFIRMED” app users a link to POAP (Proof of Attendance Protocol).

POAP offers its users “a new way of keeping long-lasting records of life experiences (by way of) a digital collectible created as an NFT (non-fungible token) powered by the blockchain.”

POAP NFT tokens are usually reserved for the attendees of exclusive events.

Later, adidas sent its POAP token holders a message inviting them to join the company as they “voyage into the Metaverse”.

In their email, they stated that the POAP token acted as proof that “you were here from the beginning of this journey. Keep it safe – it may come in handy”.

adidas also bought virtual land in Sandbox, a new Metaverse-based gaming app.

POAP token holders are expected to get access to virtual wearables for the game as well as the chance to purchase exclusive physical products.

At the time of writing, the adidas POAP digital tokens now change hands for $3,600 or more.

NFTs and luxury

In the past 10 years, there has been a shift away from scarcity and craftsmanship as the defining characteristics of what many consider as “luxury”.

Wealthier millennials and Gen Zers seemed to place a high value on hard-to-replicate memories and authentic experiences that could be shared with others via social media.

Luxury could be now considered as eating at starred restaurants offering the latest cutting edge cuisine or holidaying somewhere off the beaten track. The “old” luxury was about what we wanted just as individuals.

But, in the next two years, we see NFTs as bringing back to luxury the exclusivity that once defined it.

How might this occur?

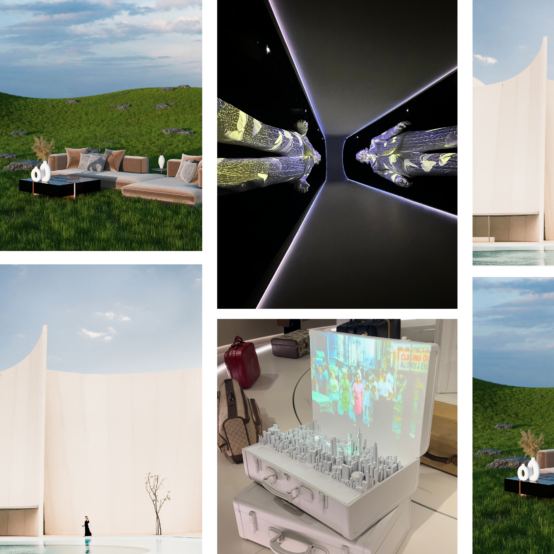

Gucci, Burberry, and Louis Vuitton are some of the first luxury brands to enter the NFT and Metaverse spaces with exclusive digital clothing, gaming skins, digital artwork, and online avatars.

Given the demand for NFTs and the prices they command, owners of NFTs may be justified in seeing these tokens as outward displays of their wealth and status.

Owners will be able to showcase their collection of NFT-associated assets to others within the gaming and interactive platforms they frequent. As described by Bloomberg, your digital avatar could “wear Burberry “skins” and carry Gucci handbags that are not leather totes but non-fungible tokens”.

Luxury watch manufacturer Patek Philip revealed an NFT based on its famed and discontinued timepiece “Nautilus” in November 2021 – ideal for the Metaverse.

Some luxury NFTs come with real-world manifestations of the product being represented digitally. For example, you get a real coat at the same time as you get a virtual coat. If you buy a luxury watch NFT, you now might get both a physical watch and a digital file which acts as a certificate of authenticity.

You could use the digital wallet app on your phone to show off your collection of NFTs to others.

Proof of NFT ownership might become a passport allowing access to exclusive events online and offline. Each event you attend will generate an NFT of its own to offer proof of attendance.

You may not even need a digital wallet. Soon, you’ll be able to link the NFTs in your digital wallet back to your social media profile.

You can choose which NFT you want as your display picture. On Twitter, the NFT you choose will be displayed within a hexagon and not the usual roundel. It’s not hard to see how the hexagonal display pictures could become the new must-have sign of status just like the blue tick verified user status used to be if interest in NFTs continues to grow.

This is, of course, all speculation.

No-one is sure how this is going to turn out. The success of NFTs is, in large part, determined by the success or otherwise of the metaverse. There have been plenty of attempts to create digital worlds in the past and, although the tech is now much better, there is no compelling evidence that we will live in a Ready Player One type of virtual reality world any time soon.

And if there is mass adoption, will NFTs develop into two different classes? One class with an accompanying physical product and one without?

Where there is no physical product, will luxury consumers be happy to purchase an item of clothing they can only showcase to people in a virtual world but they cannot wear in the actual presence of their friends in their favourite clubs and nightspots?

Last but not least – will NFT prices hold? Will wealth managers and family office managers see NFTs as a stable store of value given their current price volatility? Remember that NFTs must be purchased with cryptocurrency which has its own price volatility issues.

There seems to be something in NFTs but, barely a year into widespread interest in the tokens, it’s difficult to tell the longer-term direction of travel for the sector.

Find out more

Sign up here to receive our presentation on “The Future of Luxury Creative” which talks about NFTs in more detail.

We will be hosting an event on NFTs soon, sign up to our newsletter to find out more. If you want to chat to an expert, please get in touch and contact us here.